Credit Guarantee Fund Scheme Online Registration | Credit Guarantee Scheme Login Process | Credit Guarantee Scheme Application Form | CGTMSE Scheme Apply Online

To prove support to the entrepreneur, the Government of India launches various kinds of schemes. Through these schemes, financial support is provided to the entrepreneurs to scale up their businesses. Recently the Government of India has launched a Credit Guarantee Scheme.

Through this scheme, Bank credits will be made available to the entrepreneurs. So that they can realize their dream of setting up units. This article covers all the important aspects of the CGTMSE scheme. You will get to know how you can take advantage of this scheme by going through this article. Other than that, you will also get details regarding its objective, benefits, features, eligibility, required documents, application procedure, etc.

🢡 Credit Guarantee Scheme 2022

The ministry of micro small and medium enterprises Government of India launched a Credit Guarantee Scheme to strengthen the credit delivery system and facilitate the flow of credit to the MSE sector. Through this scheme, bank credit will be provided without hassles of collateral or third-party guarantees.

Credit will be provided to the first-generation

entrepreneurs so that they can realize their dream of setting up a unit of

their micro and small enterprises. To implement this scheme, the Government of

India and SIDBI have set up a credit guarantee fund trust for micro and small

enterprises.

🢡 Expansion Of Credit Guarantee Scheme

As you all may be aware that on 1st February 2022 the finance minister Nirmala Sitharaman for the financial year 2022-23. In the budget, she has announced to extend the emergency credit line guarantee scheme till March 2023. This expansion will help meet the working capital requirements of the businesses. More than 1.3 crore MSMEs will be helped through this expansion.

Its Total guarantee cover will be expanded by 50 thousand

crores to a total of 5 lakh crore. This additional amount will be exclusively

earmarked for hospitality and related enterprises. This scheme will also be

revamped with the required fusion of the fund. This will facilitate additional

credit of 2 lakh crore to the MSME and expand employment opportunities

🢡 Key Highlights Of Credit Guarantee Scheme

|

Name Of The Scheme |

Credit Guarantee Scheme |

|

Launched By |

Government Of India |

|

Beneficiary |

Citizens Of India |

|

Objective |

To Provide Credit Guarantee Facility |

|

Official Website |

|

|

Year |

2022 |

🢡 Objective Of Credit Guarantee Scheme

The main objective of the Credit Guarantee Scheme is to provide credit guarantee facilities to entrepreneurs so that they can scale up their businesses by taking loans. The Government of India is going to provide a credit guarantee against the loan of the entrepreneur. The benefit of this scheme is generally provided to first-generation entrepreneurs.

If the entrepreneur fails to pay back the loan within the stipulated time then

through this scheme the lender will be paid by the credit guarantee trust up to

50%, 75%, 80%, or 85% of the loss incurred by the lender. This scheme will

ensure the easy flow of credit into the business. With the implementation of

this scheme, entrepreneurs will get investment easily which will automatically

contribute to increasing the GDP of the country.

🢡 Credit Guarantee Under Credit Guarantee Scheme

The maximum cap to any collateral third party guarantee for free

credit facility extended by the Eligible institution to new as well as existing

micro and small enterprises will be 200 lakh. The guarantee coverage will be

made available to the selected NBFCS and small finance Bank. 50%, 75%, 80%, and

85% guarantee cover will be made available under the scheme for the sanctioned

amount. The credit facility for credit up to Rs 5 lakh for micro-enterprises

the extent of guarantee is 85%. The extent of guarantee cover is 50% up to a

credit of Rs 10 lakh to 200 lakh per MSE borrowers in the retail trade

activity.

The guarantee cover is 80% for micro and small enterprises that are operated or owned by women and all credit or loans in the northeast region for credit facility up to Rs 50 lakh. If there is any default then the trust settles the claim up to 75% of the amount. Interest on the loan will be applicable as per RBI guidelines.

🢡 Types Of Credit Guarantee Scheme

· Credit guarantee scheme for banks- To fund the micro and small enterprises the Government of India has framed this scheme. Through this

· scheme guarantees are provided in respect of credit facility by the lending institution to the borrowers in the micro and small enterprises

· Credit guarantee scheme for NBFC- Through this scheme credit facilities are extended by the eligible NBFCS to the borrowers in the micro and small enterprises

· Sub debt scheme- Through this scheme guarantee coverage is provided to the scheduled commercial bank to provide personal loan through the banks to the promoters of the stressed MSME to infuse equity or sub-debt or quasi-equity etc

· PM Seva Nidhi- This scheme has been launched by the government of India to support urban Street vendors. Credit guarantee coverage is provided to the member lending institution to enable them to extend credit facilities to the street vendors to meet their working capital requirement

🢡 Benefits And Features

· The ministry of micro small and medium enterprises Government of India launched a Credit Guarantee Scheme to strengthen the credit delivery system and facilitate the flow of credit to the MSE sector.

· Through this scheme bank credit will be provided without hassles of collateral or third-party guarantees.

· Credit will be provided to the first-generation entrepreneurs so that they can realize their dream of setting up a unit of their micro and small enterprises.

· To implement this scheme the Government of India and SIDBI have set up a credit guarantee fund trust for micro and small enterprises.

· This scheme has introduced a new hybrid product allowing guarantee cover that is not covered by collateral securities.

· The MLIs will be allowed to obtain collateral security for the part of the credit facility

· The remaining part of the credit facility will be covered under the scheme up to a maximum of 200 lakh.

· If the entrepreneur is unable to pay the loan then through this scheme the lender will be paid up to a certain amount of the losses incurred by him or her.

🢡 Beneficiaries Of Credit Guarantee Scheme

· Manufacturing business

· Services related business

.· Retail trade

🢡 Category Wise Credit Guarantee

|

Category |

Maximum

extent of Guarantee where credit facility is |

|

|

|

|

Up

to 5 lakhs |

Above

5 lakhs up to 50 lakhs |

Above

50 lakhs up to 200 lakhs |

|

Micro Enterprises |

85% of the amount in default subject to a maximum of

4.25 lakh |

75% of the amount in default subject to a maximum of

37.50 lakh |

75% of the amount in default subject to a maximum of

150 lakh |

|

Women entrepreneurs/ Units located in North East

Region (incl. Sikkim) (other than credit facility up to 5 lakhs to micro-enterprises) |

80% of the amount in default subject to a maximum of

40 lakh |

80% of the amount in default subject to a maximum

of 40 lakh |

75% of the amount in default subject to a maximum of

150 lakh |

|

All other categories of borrowers

|

75% of the amount in default subject to a maximum of

37.50 lakh

|

The 75% of the amount in default subject to a

maximum of 37.50 lakh |

75% of the amount in default subject to a maximum of

150 lakh |

|

Activity |

From

10 lakh up to 100 lakhs |

|

|

|

MSE Retail Trade |

50% of the amount in default subject to a maximum of

50 lakh |

||

🢡 Ineligibility Of Credit Guarantee Scheme

·

Educational/training institution

·

Self-help groups

·

Agriculture

🢡 Operational Highlights Of Credit Guarantee Scheme

|

Guarantee approved during the financial year 2020 |

₹45,851 crore |

|

Growth and coverage in terms of the amount |

52% |

|

Significant growth of new products-retail and hybrid |

₹16103 crore |

|

Guarantees improved during the financial year 2020

for 23 new registered NBFC |

₹17,349 crore |

🢡 Extent Of Guarantee Cover Of Credit Guarantee Scheme

·

Up to Rs 5 lakh micro-enterprises- 85%

·

Up to 50 lakh women entrepreneurs/units located in the North-eastern

region including Sikkim- 80%

·

From 5 lakh to 200 lakh for another categories- 75%

·

Up to Rs 100 lakh MSE retail trade- 50%

🢡 Steps In Getting Coverage

·

Applicant registration

·

GST details

·

ITR upload

·

Data fill up

·

Select bank for processing

·

Provisional guarantee certificate

🢡 Member Lending Institute Under Credit Guarantee Scheme

·

12 public sector bank

·

22 private sector banks

·

51 RRB

·

5 foreign banks

·

9 Financial institutions

·

28 NBFC

·

6 SFB

·

8 SUCB

🢡 Eligibility Criteria And Required Documents

·

Applicant must be permanent resident of India

·

The applicant must be first-generation entrepreneur

·

Aadhar Card

·

Ration card

·

Income certificate

·

Passport size photograph

·

GST details

·

Income tax return

·

Bank account details

·

Mobile number

·

Email ID etc

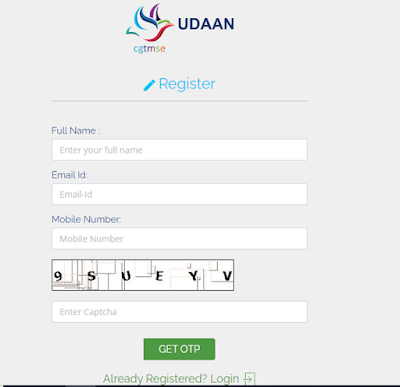

🢡 Procedure To Apply Under Credit Guarantee Scheme

·

First of all go to the official website of credit

guarantee scheme

|

| Credit Guarantee Scheme (CGTMSE) 2022: Online Registration |

·

The home page will open before you

·

On the homepage you are required to click on register

·

You will be redirected to a new page

·

On this page again after clicking on register

·

After that you have to enter your full name, email id, mobile

number, and captcha code

·

Now you have to click on get OTP

·

After that you have to enter OTP into the OTP box

·

Now you have to click on register

·

After that you have to login by entering

your login credentials

·

Now you have to enter your GST details

·

After that you have to upload your income tax return

·

Now you have to enter the required details

·

After that you have to update your bank account details

·

Now you have to click on submit

·

By following this procedure you can apply under credit guarantee

scheme

🢡 Procedure To Do Member Login

·

Go to the official website of

credit guarantee scheme

·

The home page will open before you

·

Now you are required to click on members login

·

Following options will appear before you:-

·

Credit guarantee scheme for banks

·

Credit guarantee scheme for nbfc

·

You have to click on the option of your choice

·

A new page will appear before you

·

On this page you have to enter your login credentials

·

After that you have to click on login

·

By following this procedure you can 2 member login

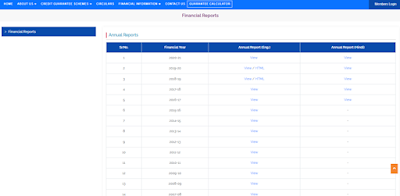

🢡 Download Financial Report

·

Visit the official website of

credit guarantee scheme

·

The home page will open before you

·

Now you have to click on financial information Option.

·

After that you have to click on financial report

·

A new page will appear before you

·

On this page you have to click on the option of your choice

·

Required details will be on your computer screen

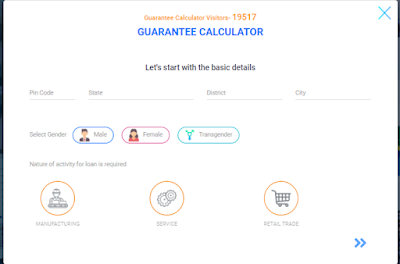

🢡 Procedure To Calculate Guarantee

·

Go to the official website of credit

guarantee scheme

·

The home page will open before you

·

On the homepage you are required to click on guarantee calculator

·

You will be redirected to a new page

·

On this page you have to enter your pin code, state, district, city,

gender, and nature of activity

·

After that you have to click on submit

·

Required details will be on your computer screen

🢡 Procedure To View Contact Details

·

Visit the official website of

credit guarantee scheme

·

The home page will open before you

·

Now you are required to click on contact us

·

A new page will appear before you

·

On this page you can view contact details

|

| Gujarat Sarkari Yojana 2022 | સરકારી યોજનાઓ 2022 | सरकारी योजना लिस्ट 2022 |